Skilled Management of

Your Wealth

“Coming together is a beginning. Keeping together is progress. Working together is success.”

HENRY FORD

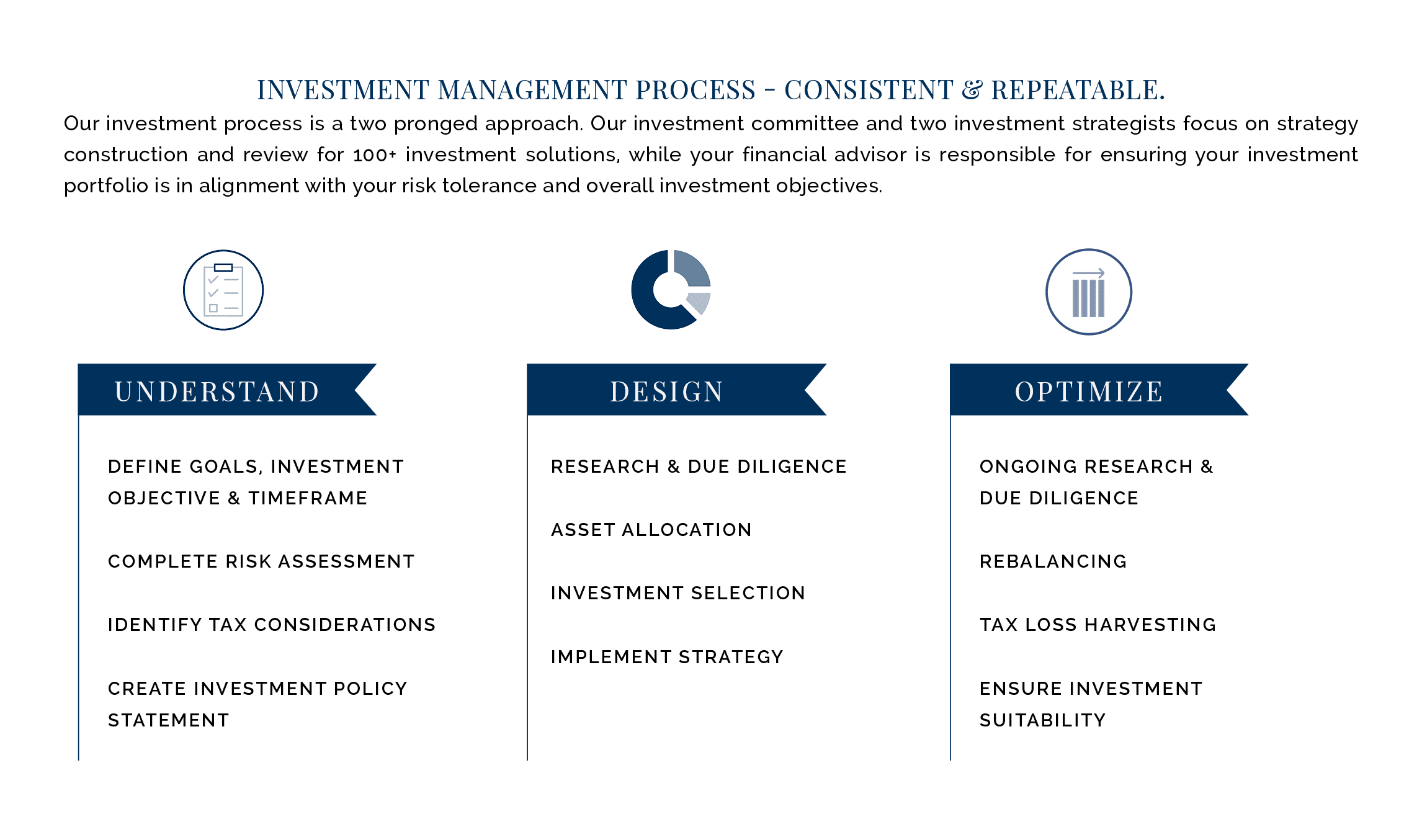

Our investment management philosophy revolves around the alignment of your financial resources with the vision and goals you have for your life – both today and tomorrow. This is where life and wealth optimizations come into play. It helps bring a personal balance to life because each is aligned with the other – asset management based around goals and goals based on what can be afforded.

An important part of managing your wealth is planning for retirement. That’s because preserving your wealth and maintaining your standard of living will be among your highest priorities once you retire. Because people are living longer today, the possibility of spending 30 years in retirement requires careful preparation and disciplined investing. We can create a plan for monthly distributions from your portfolio designed to help preserve your principal. * We can also assist you with longevity planning, required minimum distributions, income planning, tax planning, proper account titling and beneficiaries, multigenerational wealth transfer, charitable giving, and asset preservation and reallocation.

MAKE YOUR MARK ON

THE FUTURE

“Coming together is a beginning. Keeping together is progress. Working together is success.”

HENRY FORD

The freedom to leave a legacy to benefit others is a rewarding feeling like no other. But leaving an enduring legacy takes the right solutions – such as trusts, wills and insurance – combined with the prudent selection, balance and placement of investments. To help, we provide an extensive array of tax, trust and financial planning expertise to ensure your wishes are implemented.

Through proper estate planning, you can help ensure your assets accumulated over your lifetime are preserved for the use you have intended. This can include providing income for your spouse, educating children or grandchildren or leaving money to your favorite charity. A well-designed estate plan can also help mitigate your family’s tax burden. We can offer financial strategies designed to efficiently manage the transfer of wealth from one generation to the next, and mitigate related tax issues. And by coordinating our efforts with your tax and legal professionals and working closely with you and your family, we will strive to help you establish a financial tradition that can be passed on for generations.

our team

Through the bonds of long and lasting relationships, we enjoy the freedom to encourage, inspire and guide our clients.